Avoid Being Scammed by Fake Hurricane Charities

- TandV

- Oct 6, 2017

- 24 min read

Article Highlights:

Fraudsters

Urgent Appeals

Tips to Avoid Scams & ID Theft

Tax Documentation of Cash Contributions

Whenever there is a disaster such as the recent hurricanes, the lowlifes show up and try to scam generous individuals out of money intended to go to victims of the disaster. Don’t you be another victim of the disaster – watch out for scammers claiming to represent charitable organizations who will pocket the donations for themselves instead. Besides fraudsters soliciting on behalf of bogus charities, some so-called charities aren’t entirely honest about how they use contributions. You may receive phone calls, emails, snail mail, or appeals on social networking sites for donations to help the victims of the recent hurricanes; some of these appeals may be coming from fraudsters and not legitimate charities. Unfortunately, this happens often after natural disasters such as earthquakes and floods. So before writing a check or giving your credit card number to a charity that you aren’t familiar with, check them out so you can be assured that your donation will end up in the right hands. Follow these tips make sure that your charitable contributions will actually go to the cause you are supporting:

Donate to charities that you know and trust. Be alert for charities that seem to have sprung up overnight in connection with current events.

Ask if a caller is a paid fundraiser, who he/she works for, and what percentages of your donation go to the charity and to the fundraiser. If you don’t get clear answers – or if you don’t like the answers you get – consider donating to a different organization.

Don’t give out personal or financial information – such as your credit card or bank account number – unless you know for sure that the charity is reputable.

Never send cash. You can’t be sure that the organization will receive your donation, and you won’t have a record for tax purposes.

Never wire money to someone who claims to be from a charity. Scammers often request donations to be wired because wiring money is like sending cash: once you send it, you can’t get it back.

If a donation request comes from a charity that claims to help a local community group (for example, police or firefighters), ask members of that group if they have heard of the charity and if it is actually providing financial support.

Check out the charity’s reputation online using Charity Watch, or other online watchdogs.

Contributions you make to legitimate charities may be tax-deductible, but only if the donations are to religious, charitable, scientific, educational, literary, or other institutions that are incorporated or recognized as organizations by the IRS. These organizations are sometimes referred to as 501(c)(3) organizations (after the code section that allows them to be tax-exempt). Gifts to federal, state, or local government; qualifying veterans’ or fraternal organizations; and certain nonprofit cemetery companies may also be deductible. Gifts to other kinds of nonprofits, such as business leagues, social clubs, and homeowner’s associations, as well as gifts to individuals cannot be deducted. To claim a cash contribution, you must be able to document that contribution with a bank record, a receipt, or a written communication from the qualified organization; this record must include the name of the qualified organization and the date and amount of the contribution. Valid types of bank records include canceled checks, bank or credit union statements, and credit card statements. In addition, to deduct a contribution of $250 or more, you must have an acknowledgment of your contribution from the qualified organization; you’ll also need certain payroll deduction records instead if you made your donation through work. Be aware that you must also itemize your deductions to claim a charitable contribution. It may also be beneficial for you to group your deductions in a single year and then skip deductions in the next year. Please contact this office if you have questions related to the tax benefits associated with charitable giving for your particular tax situation.

Are Your Important Tax Documents Safe in Case of a Disaster?

Article Highlights:

Potential Damage to Key Records

Duplicating and Storing Remotely

Digitizing Records and Storing Them on a Remote Server

Protecting Key Photographs

You may think a natural or man-made disaster will never happen to you, but it can be a nightmare when it does. The 2017 hurricane season is a good example, not to mention the wildfires in the West, the tornados in the Midwest, plus the potential for inevitable earthquakes. You could lose all of your tax records, business records, insurance policies, birth certificates, and other key documents. You can help yourself by storing duplicates of important or irreplaceable documents in a waterproof container away from the original set. If you think this will be too difficult, at least keep the original documents in a waterproof container. If you are computer savvy, an easier way to keep your records out of harm’s way is to store digital copies of the documents on a remote server (i.e., in the cloud). It may cost a few bucks, but the digital files will be there when you need them, regardless of what happens to your home or business location. Most financial institutions these days provide all of their documents digitally, and you can store those documents on your remote server or even retrieve them from the financial institution’s website. However, before relying on the financial institutions, make sure they retain your records for long enough to meet your needs. For example, you generally need to keep individual tax records for up to 3 years after the tax return due date for the tax year or the date when you filed the return, if it was filed after the due date. For example, your 2016 return was due April 18, 2017. If you filed it on or before April 18, the statute of limitations for the 2016 return would not run out until April 15, 2020. So, you would have to keep the records until then for the 2016 tax return. (The statute of limitations runs for 4 years for some states, and some records need to be kept longer for both federal and state purposes.) If some of your files are not already available digitally, you can always scan the originals to create digital copies. Another very important thing to everyone is family photos. Modern-day pictures are digital, so you can save them on a remote server, or many photo services will save them online for you. For the older important ones, you can scan them or take digital pictures of them with your camera. Another important document to have is a list of your home’s and business facility’s contents for insurance purposes. The quick and easy way is to take a video or pictures throughout the house or business showing the furnishings and equipment. A better method is to take the pictures or video and back them up with a detailed list of the items in each room. Self-Help Publications:

IRS Publication 2194, Disaster Resource Guide for Individuals and Businesses

IRS Publication 583, Starting a Business and Keeping Records

Tax Relief in Disaster Situations

Federal Emergency Management Agency

Small Business Administration

Disasterassistance.gov

Ready.gov

Please give this office a call if you have questions about retaining records or if we can provide any other assistance.

A Novel Way to Make Hurricane Relief Donations

Article Highlights:

Donating unused vacation time, sick leave and personal time

Employer’s Function

Great Donation Opportunity

As they have done before in the wake of disasters, including Hurricane Katrina and Superstorm Sandy, the Internal Revenue Service is providing special relief that allows employees to donate their unused paid vacation, sick leave, and personal leave time to recent hurricane relief efforts.

Here is how it works: if your employer is participating, you can relinquish any unused and paid vacation time, sick leave and personal leave for cash payments which your employer will qualified hurricane relief charitable organizations. The cash payment will not be treated as wages to you and your employer can deduct the amount donated as a business expense. However, since the income isn’t taxable to you, you will not be allowed to claim the donation as a charitable deduction on your tax return. Even so, excluding income is often worth more as tax savings than a potential tax deduction, especially if you generally claim the standard deduction or you are subject to AGI-based limitations. This special relief applies to all donations made before January 1, 2019, giving individuals over a year to forgo their unused paid vacation, sick and leave time and have the cash value donated to a worthy cause. This is a great opportunity to provide sorely needed help in the aftermath of the recent hurricanes without costing you anything but time. Contact your employer to make a donation. If your employer is unaware of his program refer them to IRS Notice 2017-48 for further details. If you have questions related to donating leave time for hurricane relief efforts or other charitable contributions, please contact this office.

Enhance Your Cash Flow, Enhance Your Business: The Top Tips You Need to Know

We've discussed at length in the past about how cash flow is ultimately one of the most important factors of a business that far too many people just aren't paying enough attention to. Cash flow maintenance is about more than just knowing how much money is coming in versus how much money is going out. Even if your business is very close to true profitability, this ultimately won't mean a thing if you're dealing with clients who are slow to pay. This can seriously impact your momentum, and worse — your chances at long-term success. To put it simply, enhancing your cash flow isn't just about enhancing your accounting — it's also about enhancing the very organization you've already worked so hard to build. With that in mind, there are a few key tips you'll absolutely need to know about moving forward. Technology Is Your Friend. It's Time to Start Acting Like It Perhaps the most important tip that you should start using to enhance your cash flow (and thus, your entire business) is to start leveraging the power of modern technology to your advantage. There are a wide range of different financial solutions that allow you to not only submit invoices to clients electronically, but that then allow those clients to pay you in exactly the same way. Not only will this make it far, far easier for you to track money that is still "in play" so to speak, but it will also significantly help shorten the time it takes to get you paid for your products and services in the first place. This means that money will be coming in at a much faster rate, helping to make sure that you have the cash on hand necessary to take advantage of certain opportunities as they develop. Use Your Credit Cards in the Right Ways Another key tip that you can use to enhance your cash flow actually involves using your company credit card for purchases that you may otherwise pay for by check. Using your company credit card gives you an extra grace period to pay off the card in full each month. This essentially allows you to "push" that cash payment down the road, giving you a bit more breathing room than you'd have rather than the net 15 or net 30 that you'd be dealing with for check-based payments. Get Organized and Stay That Way

Perhaps the most important step that entrepreneurs can take to enhance their cash flow involves not just getting organized, but doing anything that they have to in order to stay that way as long as possible. Consider creating different types of tier groups in your records, clearly separating people based on when they absolutely need to be paid.

Order everyone by who must be paid first — meaning that you're definitely going to want to prioritize the government, payroll and certain vendors that may shut off your access to resources before anyone else. Certain others, on the other hand, can easily be paid later without too much undo fuss. Sure, you'd love to be able to pay everyone at the same time — but in the event that you can't, this information will be invaluable to have when making strategic decisions regarding where your available funds should go.

This itself can also help identify certain trends and patterns that make the next six, 12 and 24 months of essential decisions far easier to predict.

Never Be Afraid to Consult a Professional

At the end of the day, the most important tip that you need to not just understand but truly believe in with regards to cash flow is that you should never be afraid to enlist the help of a trained professional. You're a business leader and you're good at what you do. You wouldn't have gotten this far if you weren't. However, that doesn't make you a financial expert and it certainly doesn't mean that you'll have the time necessary in a day to devote to something as mission-critical as proper bookkeeping and other financial tasks. In certain cases you might, sure — but if you start to feel like this is getting overwhelming, it is in your own best interest to pick up the phone and find someone who can lend you a much-needed helping hand. Find an accounting expert who doesn't just have experience in terms of cash flow, but who understands your niche and knows exactly how a business just like yours needs to perform. Not only will this help put you in a better position to make positive cash flow gains moving forward, but it'll also give you the essential peace of mind that only comes with knowing your financial needs are being properly (and actively) taken care of.

Hurricane Disaster Loss Tax Ramifications

Article Highlights:

Disaster Losses

Elections

Net Operating Loss

AGI Limitations

Possible Gain

Filing Extensions

With the historic flooding and damage caused by recent hurricanes, President Trump has declared the affected areas disaster areas. If you were an unlucky victim and suffered a loss as a result of these disasters, you may be able to recoup a portion of that loss through a tax deduction. When you suffer a casualty loss within a federally declared disaster, you can elect to claim the loss in one of two years: the tax year in which the loss occurred or the immediately preceding year.

Income Tax Casualty Loss - By taking the deduction for a 2017 disaster area loss on the prior year (2016) return, you may be able to get a refund from the IRS before you even file your tax return for 2017, the loss year. You have until six months after the original due date of the 2017 return to make the election to claim it on your 2016 return, in most cases by filing an amended 2016 return to claim the disaster loss. Before making the decision to claim the loss in 2016, you should consider which year’s return would produce the greater tax benefit, as opposed to your desire for a quicker refund. If you elect to claim the loss on either your 2016 original or amended return, you can generally expect to receive the refund within a matter of weeks, which can help to pay some of your repair costs. If the casualty loss, net of insurance reimbursement, is extensive enough to offset all of the income on the return, whether the loss is claimed on the 2016 or 2017 return, and results in negative income, you may have what is referred to as a net operating loss (NOL). When there is an NOL, the unused loss can be carried back two years and then carried forward until it is all used up (but not more than 20 years), or you can elect to only carry the unused loss forward. Determining the more beneficial year in which to claim the loss requires a careful evaluation of your entire tax picture for both years, including filing status, amount of income and other deductions, and the applicable tax rates. The analysis should also consider the effect of a potential NOL.

Ordinarily, casualty losses are deductible only to the extent they exceed $100 plus 10% of your adjusted gross income (AGI). Thus, a year with a larger amount of AGI will cut into your allowable loss deduction and can be a factor when choosing which year to claim the loss.

For verification purposes, keep copies of local newspaper articles and/or photos that will help prove that your loss was caused by the specific disaster.

As strange as it may seem, a casualty might actually result in a gain. This sometimes occurs when insurance proceeds exceed the tax basis of the destroyed property. When a gain materializes, there are ways to exclude or postpone the tax on the gain.

Extension of Filing and Payment Due Dates – The IRS has announced that Hurricane Harvey and Irma victims have until Jan. 31, 2018, to file certain individual and business tax returns and make certain tax payments. This tax relief postpones various tax filing and payment deadlines that occurred starting on:

Aug. 23, 2017 for Harvey victims,

September 4, 2017 for Irma victims in Florida, and

September 5, 2017 for Irma victims in Puerto Rico and the Virgin Islands.

As a result, affected individuals and businesses will have until Jan. 31, 2018, to file returns and pay any taxes that were originally due during this period. This includes:

The Sept. 15, 2017 and Jan. 16, 2018 deadlines for individuals making quarterly estimated tax payments.

The 2016 income tax returns that received a tax-filing extension until Oct. 16, 2017. The IRS noted, however, that because tax payments related to these 2016 returns were originally due on April 18, 2017, those payments are not eligible for this relief and may be subject to late payment penalties.

A variety of business tax deadlines are also affected, including the Oct. 31 deadline for quarterly payroll and excise tax returns. Businesses with extensions, including among others, calendar-year partnerships whose 2016 extensions run out on Sept. 15, 2017 and calendar-year tax-exempt organizations whose 2016 extensions run out on Nov. 15, 2017, also have the additional time. The disaster relief page on www.irs.gov has details on other returns, payments and tax-related actions qualifying for the additional time.

In addition, the IRS is waiving late-deposit penalties for federal payroll and excise tax deposits normally due during the first 15 days of the disaster period. Check out the disaster relief page for the time periods that apply to each jurisdiction.

The IRS automatically provides filing and penalty relief to any taxpayer with an IRS address of record located in a disaster area. Thus, taxpayers need not contact the IRS to get this relief. However, if an affected taxpayer receives a late filing or late payment penalty notice from the IRS that has an original or extended filing, payment or deposit due date falling within the postponement period, the taxpayer should call the number on the notice to have the penalty abated. In addition, the IRS will work with any taxpayer who lives outside of a disaster area but whose records necessary to meet a deadline occurring during the postponement period are located in the affected area. Taxpayers qualifying for relief who live outside the disaster area need to contact the IRS at 866-562-5227. This also includes workers assisting the relief activities who are affiliated with a recognized government or philanthropic organization. The tax relief is part of a coordinated federal response to the damage caused by severe storms and flooding and is based on local damage assessments by FEMA. For information on disaster recovery, visit disasterassistance.gov. For information on government-wide efforts related to:

Hurricane Harvey, please visit: https://www.usa.gov/hurricane-harvey, or

Hurricane Irma, please visit: https://www.usa.gov/hurricane-irma.

If you need further information on filing extensions, casualty and disaster losses, your particular options for claiming a loss, or if you wish to amend your 2016 return to claim your 2017 loss, please give this office a call.

Hiring The Right Employee Can Get You A Big Tax Credit

Article Highlights:

Potential Credit

Eligible Employees

Credit Determination

Certification Process

Other Issues

If you are an employer who is willing to help disadvantaged individuals, you could benefit from a substantial federal tax credit. Hiring certain new employees can qualify you for the work opportunity tax credit (WOTC).

The WOTC is typically worth up to $2,400 for each eligible employee, but it can be worth up to $9,600 for certain veterans and up to $9,000 for “long-term family assistance recipients.” The credit is available for eligible employees who begin working for you before January 1, 2020.

Generally, an employer is eligible for the WOTC only when paying qualified wages to members of any of the targeted groups listed below. For more details on the required qualifications for each group, see the instructions for IRS Form 8850 (Pre-Screening Notice and Certification Request for the Work Opportunity Credit).

(1) Qualified IV-A recipients – generally, members of a family that is receiving assistance under the Temporary Assistance for Needy Families (TANF) program; (2) Qualified veterans; (3) Qualified ex-felons – generally, those hired within one year of release; (4) Designated community residents – those who are aged 18 through 39 and who are living in an empowerment zone or a rural renewal area*; (5) Vocational rehabilitation referrals – handicapped individuals who are referred by rehabilitation agencies; (6) Qualified summer youth employees – those who are 16 or 17 years old, have never previously worked for the employer and reside in an empowerment zone*; (7) Qualified members of families who participate in the Supplemental Nutritional Assistance Program (SNAP); (8) Qualified Supplemental Security Income recipients; (9) Qualified long-term family assistance recipients – those receiving TANF assistance payments; and (10) Qualified long-term-unemployed individuals. * Both empowerment zones and rural renewal areas are listed in the IRS Form 8850 instructions.

For an employer to qualify for the credit, the employee must work a minimum of 120 hours and receive at least 50% of his or her wages from that employer for working in the employer’s trade or business. Relatives of the employer and employees who have previously worked for the employer do not qualify for the credit. For an employee from most of the targeted groups, the credit is based upon the first $6,000 of first-year wages. If an employee completes at least 120 hours but less than 400 hours of service for the employer, the credit is equal to those wages multiplied by 25%. If the employee completes 400 or more hours of service, the credit is equal to the wages multiplied by 40%. Thus, the maximum credit per employee in one of these groups would be $2,400 (.4 x $6,000). For the summer youth employees, only the first $3,000 of the first-year wages are taken into account, resulting in a maximum per-employee credit of $1,200 (.4 x $3,000) Two categories allow for higher first-year wages to be taken into account when calculating the credit:

Long-term family assistance recipients – For this category, the first-year wage that can be taken into account for the credit is increased to $10,000, thus allowing a maximum credit of $4,000 (.4 x $10,000). In addition, this group qualifies for a credit in the second year (immediately following the first year); this is equal to 50% of second-year wages up to $10,000.

Veterans – The three possible qualifications of veterans have applicable first-year wages for the credit of up to $12,000, up to $14,000 and up to $24,000. Thus, the maximum credit for this group is between $4,800 (.4 x $12,000) and $9,600 (.4 x $24,000), depending upon the qualification.

Certification Process - To be eligible to claim the WOTC, the employer must file Form 8850 with its state workforce agency no later than 28 days after an eligible employee begins work. Once the worker is state-certified as a member of a targeted group and has worked sufficient hours, the employer can claim the WOTC on Form 5884 (Work Opportunity Credit). Other Issues:

No Dual Benefits – No deduction is allowed for the portion of wages equal to the WOTC for that tax year.

Unused Current-Year Credit – The credit is included in the general business credit, and if an employer’s credit is greater than its income-tax liability (including the alternative minimum tax), the excess credit is considered an unused credit that is available for use on another year’s return. The unused credit is first carried back one year (generally by amending the return for the carryback year) and then carried forward until any remaining credit is used up (but for no more than 20 years).

In some circumstances, electing not to claim the credit is more beneficial for the employer. Please call this office for additional information related to the WOTC and to see if it would be beneficial in your particular tax circumstances.

Natural Disaster Charity Volunteer Tax Breaks

Article Highlights:

Away-from-home travel

Lodging and meals

Entertaining for charity

Automobile travel

Uniforms

Substantiation requirements

If you volunteered your time for a charity in the aftermath of a natural disaster, you probably qualify for some tax breaks. Although no tax deduction is allowed for the value of services performed for a qualified charity or federal, state or local governmental agency, some deductions are permitted for out-of-pocket costs incurred while performing the services. The following are some examples:

Away-from-home travel expenses while performing services for a charity, including out-of-pocket round-trip travel costs, taxi fares, and other costs of transportation between the airport or station and hotel, plus 100% of lodging and meals. These expenses are only deductible if there is no significant element of personal pleasure associated with the travel or if your services for a charity do not involve lobbying activities.

The cost of entertaining others on behalf of a charity, such as wining and dining a potentially large contributor (but the costs of your own entertainment and meals are not deductible).

If you use your car or other vehicle while performing services for a charitable organization, you may deduct your actual unreimbursed expenses that are directly attributable to the services, such as gas and oil costs, or you may deduct a flat 14 cents per mile for the charitable use of your car. You may also deduct parking fees and tolls.

You can deduct the cost of the uniform you wear when doing volunteer work for the charity, as long as the uniform has no general utility. The cost of cleaning the uniform can also be deducted.

There are some misconceptions as to what constitutes a charitable deduction, and the following are frequently encountered issues:

No deduction is allowed for the depreciation of a capital asset as a charitable deduction. This includes vehicles and computers.

Example: Kathy volunteers as a member of the sheriff’s mounted search and rescue team. As part of volunteering, Kathy is required to provide a horse. Kathy is not allowed to deduct the cost of purchasing her horse or to depreciate her horse. She can, however, deduct uniforms, travel, and other out-of-pocket expenses associated with the volunteer work.

However, a taxpayer may deduct the cost of maintaining a personally owned asset to the extent that its use is related to providing services for a charity. Thus, for example, a taxpayer is allowed to deduct the fuel, maintenance, and repair costs (but not depreciation or the fair rental value) of piloting his or her plane in connection with volunteer activities for the Civil Air Patrol. Similarly, a taxpayer—such as Kathy in our example, who participated in a mounted posse that is a civilian reserve unit of the county sheriff’s office—could deduct the cost of maintaining a horse (shoeing and stabling). A taxpayer who buys an asset and uses it while performing volunteer services for a charity can’t deduct its cost if he or she retains ownership of it. That’s true even if the asset is used exclusively for charitable purposes.

No charitable deduction is allowed for a contribution of $250 or more unless you substantiate the contribution with a written acknowledgment from the charitable organization (including a government agency). To verify your contribution:

Get written documentation from the charity about the nature of your volunteering activity and the need for related expenses to be paid. For example, if you travel out of town as a volunteer, request a letter from the charity explaining why you’re needed at the out-of-town location.

You should submit a statement of expenses to the charity if you are paying out of pocket for substantial amounts, preferably with a copy of the receipts. Then, arrange for the charity to acknowledge the amount of the contribution in writing.

Maintain detailed records of your out-of-pocket expenses—receipts plus a written record of the time, place, amount, and charitable purpose of the expense.

For additional details related to expenses incurred as a charity volunteer, please contact this office.

Quickbooks Tip: Creating Customer Statements in QuickBooks.

Let’s say you have a regular customer who used to pay on time, but he’s been hit-and-miss lately. How do you get him caught up? Or, one of your customers thinks she’s paid you more than she owes. How do you straighten out this account? Both of these situations have a similar solution. QuickBooks’ statements provide an overview of every transaction that has occurred between you and individual customers during a specified period of time. They’re easy to create, easy to understand, and can be effective at resolving payment disputes. A Simple Process

Here’s how they work. Click Statements on the home page, or open the Customers menu and select Create Statements. A window like this will open:

QuickBooks provides multiple options on this screen so you create the statement(s) you need.

First, make sure the Statement Date is correct, so your statement captures the precise set of transactions you want. Next, you have to tell QuickBooks what that set is. Should the statement(s) include transactions only within a specific date range? If so, click the button in front of Statement Period From, and enter that period’s beginning and ending dates by clicking on the calendar graphic. If you’d rather, you can include all open transactions by clicking on the button in front of that option. As you can see in the screenshot above, you can choose to Include only transactions over a specified number of days past due date.

Choosing Customers Now you have to tell QuickBooks which customers you want to include in this statement run. Your options here are:

All Customers.

Multiple Customers. When you click on this choice, QuickBooks displays a Choose button. Click on it, and your customer list opens in a new window. Click on your selections there to create a check mark. Click OK to return to the previous window.

One Customer. QuickBooks displays a drop-down menu. Click the arrow on the right side of the box, and choose the correct one from the list that opens.

Customers of Type. Again, a drop-down list appears, but this one contains a list of the Customer Types you created to filter your customer list, like Commercial and Residential. You would have assigned one of these to customers when you were entering data in their QuickBooks records (click the Additional Info tab in a record to view).

Preferred Send Method. E-mail or Mail?

Miscellaneous Options At the top of the right column, you can select a different Template if you’d like, or Customize an existing one. Not familiar with the options you have to change the layout and content of forms in QuickBooks? We can introduce you to the possibilities.

Below that, you can opt to Create One Statement either Per Customer or Per Job. The rest of the choices here are pretty self-explanatory – except for Assess Finance Charges. If you’ve never done this, we strongly recommend that you let us work with you on this complex process.

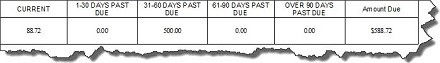

When you’re satisfied with the options you’ve selected in this window, click the Preview button in the lower left corner of the window (not pictured here). QuickBooks will prepare all the statements in the background, then display the first one. You can click Next to view them one by one. At the bottom of each, you’ll see a summary of how much is due in each aging period, like this:

It’s easy to see how much each customer is past due within each aging period. This summary appears at the bottom of statements.

After you’ve checked all the statements, click the Print or E-mail button at the bottom of the window. Other Avenues

Your company’s cash flow depends on the timely payment of invoices. Sending statements is only one way to encourage your customers to catch up on their past due accounts. There are many others, like opening a merchant account so customers can pay you online with a bank card or electronic check. If poor cash flow is threatening the health of your business, give us a call. We can work together to identify the trouble spots and get you on the road to recovery.

October 2017 Individual Due Dates

October 10 - Report Tips to Employer If you are an employee who works for tips and received more than $20 in tips during September, you are required to report them to your employer on IRS Form 4070 no later than October 10. Your employer is required to withhold FICA taxes and income tax withholding for these tips from your regular wages. If your regular wages are insufficient to cover the FICA and tax withholding, the employer will report the amount of the uncollected withholding in box 12 of your W-2 for the year. You will be required to pay the uncollected withholding when your return for the year is filed.

October 16 - Individuals

If you have an automatic 6-month extension to file your income tax return for 2016, file Form 1040, 1040A, or 1040EZ and pay any tax, interest, and penalties due.

October 16 - SEP IRA & Keogh Contributions

Last day to contribute to SEP or Keogh retirement plan for calendar year 2016 if the tax return is on extension through October 16.

October 2017 Business Due Dates

October 2 - Fiduciaries of Estates and Trusts

File a 2016 calendar year return (Form 1041). This due date applies only if you were given an extension of 5 ½ months. If applicable, provide each beneficiary with a copy of K-1 (Form 1041) or a substitute Schedule K-1.

October 15 - Taxpayers with Foreign Financial Interests

If you received a 6-month extension of time to report your foreign financial accounts to the Department of the Treasury, this is the due date for Form FinCEN 114.

October 16 - Social Security, Medicare and withheld income tax If the monthly deposit rule applies, deposit the tax for payments in September.

October 16 - Nonpayroll Withholding If the monthly deposit rule applies, deposit the tax for payments in September. October 31 - Social Security, Medicare and Withheld Income Tax

File Form 941 for the third quarter of 2017. Deposit or pay any undeposited tax under the accuracy of deposit rules. If your tax liability is less than $2,500, you can pay it in full with a timely filed return. If you deposited the tax for the quarter in full and on time, you have until November 10 to file the return.

October 31 - Certain Small Employers Deposit any undeposited tax if your tax liability is $2,500 or more for 2017 but less than $2,500 for the third quarter. October 31 - Federal Unemployment Tax

Deposit the tax owed through September if more than $500

October 2017 Individual Due Dates

October 10 - Report Tips to Employer If you are an employee who works for tips and received more than $20 in tips during September, you are required to report them to your employer on IRS Form 4070 no later than October 10. Your employer is required to withhold FICA taxes and income tax withholding for these tips from your regular wages. If your regular wages are insufficient to cover the FICA and tax withholding, the employer will report the amount of the uncollected withholding in box 12 of your W-2 for the year. You will be required to pay the uncollected withholding when your return for the year is filed. October 16 - Individuals

If you have an automatic 6-month extension to file your income tax return for 2016, file Form 1040, 1040A, or 1040EZ and pay any tax, interest, and penalties due.

October 16 - SEP IRA & Keogh Contributions

Last day to contribute to SEP or Keogh retirement plan for calendar year 2016 if the tax return is on extension through October 16.

October 2017 Business Due Dates

October 2 - Fiduciaries of Estates and Trusts File a 2016 calendar year return (Form 1041). This due date applies only if you were given an extension of 5 ½ months. If applicable, provide each beneficiary with a copy of K-1 (Form 1041) or a substitute Schedule K-1.

October 15 - Taxpayers with Foreign Financial Interests

If you received a 6-month extension of time to report your foreign financial accounts to the Department of the Treasury, this is the due date for Form FinCEN 114.

October 16 - Social Security, Medicare and withheld income tax If the monthly deposit rule applies, deposit the tax for payments in September. October 16 - Nonpayroll Withholding

If the monthly deposit rule applies, deposit the tax for payments in September.

October 31 - Social Security, Medicare and Withheld Income Tax File Form 941 for the third quarter of 2017. Deposit or pay any undeposited tax under the accuracy of deposit rules. If your tax liability is less than $2,500, you can pay it in full with a timely filed return. If you deposited the tax for the quarter in full and on time, you have until November 10 to file the return.

October 31 - Certain Small Employers Deposit any undeposited tax if your tax liability is $2,500 or more for 2017 but less than $2,500 for the third quarter. October 31 - Federal Unemployment Tax

Deposit the tax owed through September if more than $500

Comments